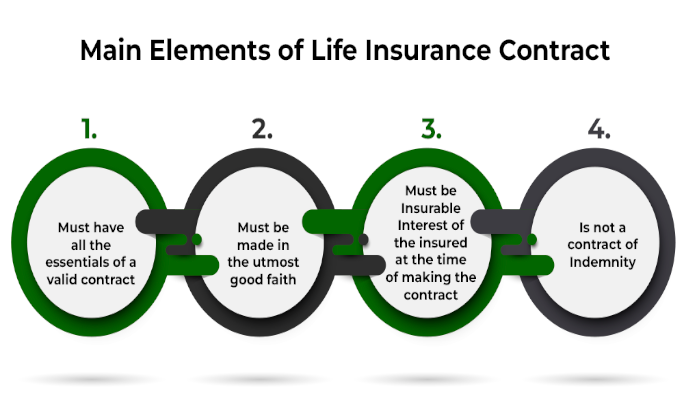

Understanding the terms and conditions of an insurance policy is essential for policyholders to ensure they are adequately protected and know their rights and responsibilities. Insurance policies are legal contracts between the insurer (the insurance company) and the insured (the policyholder), outlining the specific coverage, exclusions, and obligations of both parties. This guide will break down the key components of insurance terms and conditions, helping you navigate the often complex language of insurance policies.

1. Policy Declarations

The policy declarations, often referred to as the “dec page,” is the first section of an insurance policy and provides a summary of the key details of the coverage. It typically includes:

- Policyholder Information: The name, address, and contact details of the insured.

- Policy Number: A unique identifier for the insurance policy.

- Coverage Period: The start and end dates of the insurance coverage, indicating the duration for which the policy is in effect.

- Premium Amount: The cost of the insurance coverage, which the policyholder must pay to keep the policy active.

- Coverage Limits: The maximum amount the insurance company will pay for a covered loss.

- Deductibles: The amount the policyholder must pay out-of-pocket before the insurance company begins to pay for a covered claim.

2. Insuring Agreement

The insuring agreement is the core of the insurance policy, describing what the insurer agrees to cover in exchange for the premiums paid by the policyholder. This section outlines the types of risks or perils that the insurance policy covers and the circumstances under which the insurer will pay claims. Key elements include:

- Coverage Types: Specific types of coverage provided by the policy, such as liability coverage, property damage, personal injury protection, or health benefits.

- Covered Perils: The events or risks that the policy covers, such as fire, theft, accidents, or natural disasters, depending on the type of insurance (e.g., home, auto, health).

- Named Insured and Additional Insureds: The individuals or entities covered under the policy, including the primary policyholder and any additional insured parties.

3. Exclusions

Exclusions are specific conditions or circumstances under which the insurance policy will not provide coverage. This section is crucial because it clarifies what the policy does not cover, helping to avoid misunderstandings and disputes. Common exclusions include:

- Specific Perils: Certain risks may be excluded, such as floods, earthquakes, or acts of war. These risks might require separate insurance policies.

- Intentional Acts: Any losses caused by the policyholder’s intentional or criminal actions are typically excluded from coverage.

- Wear and Tear: Damage due to regular wear and tear, aging, or lack of maintenance is often excluded from property insurance policies.

- Pre-Existing Conditions: In health insurance, pre-existing medical conditions may be excluded from coverage, or there may be a waiting period before coverage begins.

4. Conditions

Conditions are the obligations that both the insurer and the insured must fulfill for the policy to remain valid and for claims to be honored. Failure to meet these conditions can result in the denial of a claim or cancellation of the policy. Common conditions include:

- Premium Payments: The policyholder must pay premiums on time to keep the policy active. Late or missed payments can lead to a lapse in coverage.

- Notification of Claims: The policyholder must notify the insurer promptly after a loss occurs or a claim arises. Delays in reporting can result in claim denial.

- Cooperation: The policyholder is required to cooperate with the insurer during the claims investigation, including providing necessary documentation and information.

- Proof of Loss: The policyholder may need to submit proof of loss within a specified time frame, detailing the extent of the damage or injury.

- Compliance with Laws: The insured must comply with all applicable laws and regulations. For example, in auto insurance, the policyholder must maintain a valid driver’s license and follow traffic laws.

5. Endorsements and Riders

Endorsements and riders are modifications or additions to the original insurance policy that provide additional coverage or alter existing coverage. These amendments can either broaden or restrict the coverage, depending on the policyholder’s needs. Common endorsements include:

- Additional Coverage: For example, an endorsement might add coverage for jewelry or valuable items under a homeowner’s policy.

- Exclusions: An endorsement can also exclude specific risks that are not covered under the original policy.

- Policy Extensions: Riders can extend the duration of the coverage or increase coverage limits.

6. Limits of Liability

The limits of liability section defines the maximum amount the insurer will pay for a covered loss under the policy. These limits can be applied per incident or as an aggregate limit over the policy period. Key concepts include:

- Per Occurrence Limit: The maximum amount the insurer will pay for a single incident or claim.

- Aggregate Limit: The total amount the insurer will pay for all claims during the policy period.

- Sublimits: Specific limits within the policy that apply to certain types of coverage, such as a limit on jewelry theft under a homeowner’s policy.

7. Deductibles

A deductible is the amount the policyholder must pay out-of-pocket before the insurer will pay a claim. Deductibles can vary depending on the type of coverage and the policy. Key points to understand about deductibles include:

- Flat Deductible: A fixed amount that the policyholder pays for each claim, such as $500 for an auto insurance claim.

- Percentage Deductible: A deductible that is a percentage of the insured value, often used in policies covering natural disasters like hurricanes.

- Choosing a Deductible: Higher deductibles usually result in lower premiums, but the policyholder must be prepared to pay more out-of-pocket in the event of a claim.

8. Policy Renewal and Cancellation

The terms and conditions regarding policy renewal and cancellation are critical for maintaining continuous coverage. These terms outline when and how the policy can be renewed, as well as the circumstances under which the policy can be canceled by either the insurer or the policyholder. Important aspects include:

- Renewal Terms: Policies are typically renewed annually, and the insurer may adjust premiums or coverage terms at renewal. The policyholder has the option to accept the new terms or shop for a different policy.

- Cancellation by the Insurer: The insurer may cancel the policy if the policyholder fails to meet certain conditions, such as non-payment of premiums or fraud. The insurer must provide notice of cancellation within a specific time frame.

- Cancellation by the Policyholder: The policyholder can cancel the policy at any time, but there may be penalties or a loss of premium refunds, depending on the timing of the cancellation.

9. Claims Process

The claims process section outlines the steps the policyholder must take to file a claim and how the insurer will handle the claim. Understanding this process is crucial for ensuring that claims are filed correctly and promptly. The claims process typically involves:

- Reporting a Claim: The policyholder must report the claim to the insurer as soon as possible after the loss occurs.

- Claims Investigation: The insurer will investigate the claim to determine its validity, which may involve inspecting the damage, reviewing documents, and interviewing witnesses.

- Claim Settlement: Once the investigation is complete, the insurer will either approve or deny the claim. If approved, the insurer will pay the claim amount, minus any deductible.

- Dispute Resolution: If the policyholder disagrees with the claim decision, the policy may include a process for resolving disputes, such as arbitration or mediation.

10. Policyholder Rights and Obligations

The insurance policy also outlines the rights and obligations of both the insurer and the insured. These provisions ensure that both parties understand their roles and responsibilities under the contract. Key points include:

- Right to Information: The policyholder has the right to receive clear and accurate information about the policy, including any changes to coverage or premiums.

- Right to Appeal: If a claim is denied, the policyholder has the right to appeal the decision and provide additional evidence to support the claim.

- Obligations to Mitigate Loss: The policyholder is often required to take reasonable steps to prevent further damage or loss after an incident, such as boarding up windows after a storm.

- Duty of Good Faith: Both parties must act in good faith, meaning they must be honest and fair in their dealings with each other.